Introduction: The Importance of Life Insurance and Premiums

Life insurance is an essential financial product that provides peace of mind by protecting your loved ones in the event of your passing. It can cover funeral costs, debts, and living expenses, ensuring that your family’s financial future is secure. However, when it comes to purchasing life insurance, one of the most common concerns is the premium — the amount you pay for the coverage.

Understanding what affects your life insurance rates is crucial for finding affordable coverage that still meets your needs. In this article, we will break down the key factors that determine life insurance premiums, explain how life insurance companies assess risk, and provide tips on how to secure the best rates for your policy.

What Are Life Insurance Premiums?

A life insurance premium is the amount you pay to an insurance company for coverage. Premiums can be paid annually, semi-annually, quarterly, or monthly, depending on your policy and the insurer’s terms. The cost of your premium is determined by several factors, all of which are tied to your personal risk profile.

Life insurance companies assess risk when determining premiums. The higher the risk that you will pass away unexpectedly (based on health, lifestyle, and other factors), the higher your premium will likely be. Conversely, individuals who present a lower risk will typically pay lower premiums.

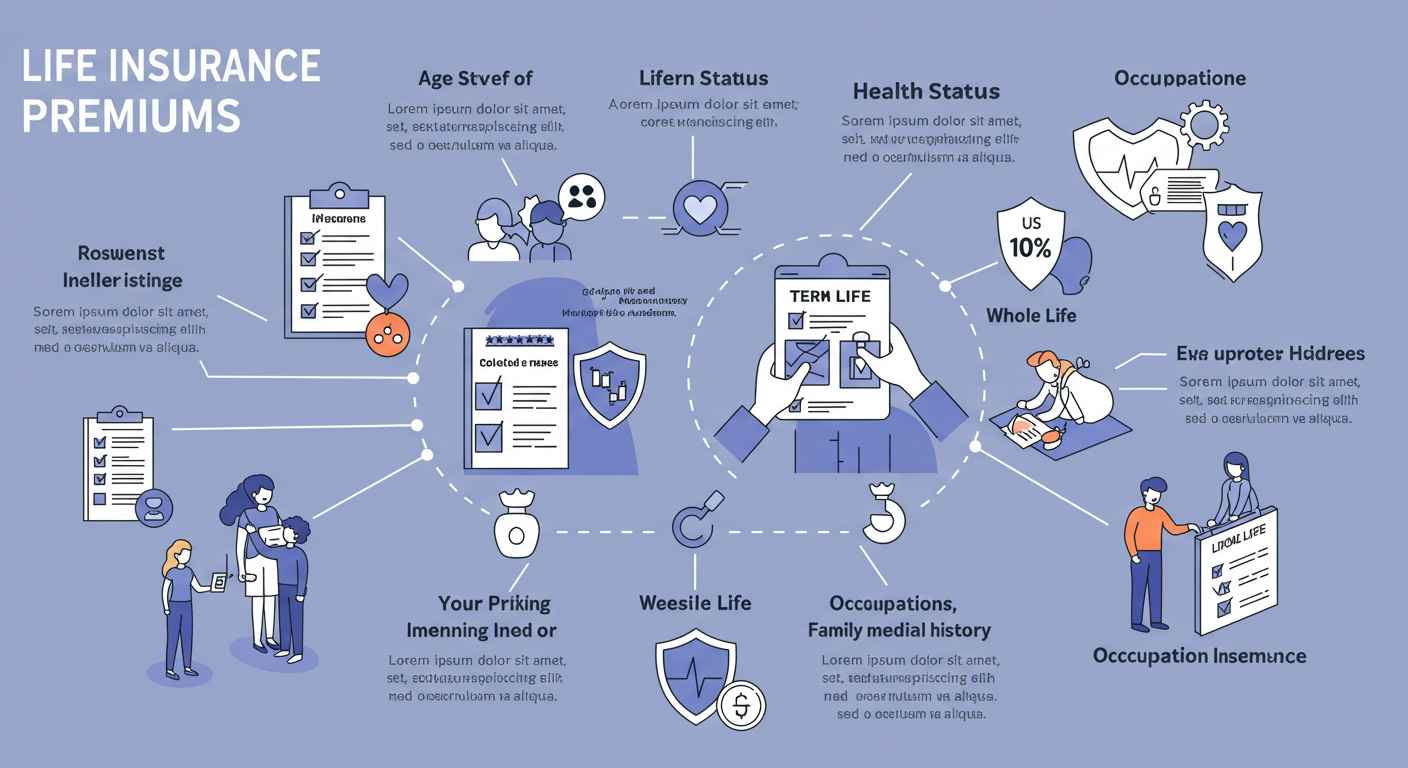

Factors That Affect Life Insurance Premiums

Several factors influence the cost of your life insurance premium. Understanding these factors can help you manage costs and potentially lower your premiums without sacrificing essential coverage. Here are the most significant factors:

- Age Age is one of the most significant factors affecting your life insurance premium. The younger you are when you purchase a policy, the lower your premium will be. This is because younger individuals are generally at lower risk of passing away, which makes them cheaper to insure. As you age, your premium will increase because the risk of death rises with age.

- Tip: If you’re considering purchasing life insurance, it’s best to buy a policy while you’re young and healthy. This can lock in a lower premium for the life of the policy, especially if you choose a term life policy.

- Gender Statistically, women tend to live longer than men, which means women generally pay lower premiums than men for the same amount of coverage. This is due to the difference in life expectancy, with women living several years longer than men on average.

- Health and Medical History Your health is one of the most significant factors that insurance companies use to calculate your life insurance premiums. Insurers assess your overall health by considering factors like your BMI (body mass index), blood pressure, cholesterol levels, and any chronic conditions such as diabetes or heart disease. Additionally, insurers may ask about your medical history, including past surgeries, hospitalizations, or family medical history. If you have pre-existing conditions or a family history of serious illnesses (e.g., cancer, heart disease), your premium may be higher because the insurer considers you to be at higher risk.

- Tip: Maintaining a healthy lifestyle — exercising regularly, eating a balanced diet, and avoiding smoking — can help you secure lower premiums.

- Lifestyle and Habits Insurance companies may also consider your lifestyle choices and habits. Smokers and individuals who engage in risky activities such as extreme sports or dangerous hobbies may face higher premiums. Smoking is a significant risk factor for health problems such as lung cancer, heart disease, and respiratory issues, all of which increase the likelihood of premature death.

- Tip: If you’re a smoker, consider quitting before purchasing life insurance. Many insurers offer lower premiums for non-smokers, and quitting can lead to a significant reduction in your life insurance rates over time.

- Occupation Your job can also impact your life insurance premiums. High-risk professions such as firefighting, mining, or construction may result in higher premiums because of the increased risk of injury or death associated with these jobs. On the other hand, office workers or those in less physically demanding roles may qualify for lower premiums.

- Policy Type and Coverage Amount The type of life insurance policy you choose (term life vs. whole life) and the amount of coverage you need will directly affect your premium. Term life insurance is generally cheaper than whole life insurance because it provides coverage for a set period (e.g., 10, 20, or 30 years) and does not accumulate cash value. Whole life insurance, on the other hand, provides coverage for your entire life and builds cash value over time, which makes it more expensive. Additionally, the more coverage you choose, the higher your premium will be. While a larger death benefit can provide greater financial security for your beneficiaries, it will come at a higher cost.

- Tip: If you’re looking for affordable life insurance, consider purchasing a term life policy. It’s typically much cheaper than whole life insurance, especially for younger individuals.

- Family History Your family medical history can impact your premium, especially if there are hereditary health conditions like cancer, heart disease, or diabetes. Insurers may charge higher premiums for individuals whose family members have a history of serious illnesses because they are considered higher risk.

- Tip: Even if you have a family history of health issues, you can still take steps to maintain good health and improve your premium rates. Insurers may offer better rates for individuals who demonstrate healthy habits and regular check-ups.

- Smoking and Alcohol Consumption Smoking is one of the biggest risk factors for life insurance premiums. Smokers are charged much higher rates than non-smokers because of the increased risk of health problems like lung cancer, respiratory disease, and heart disease. Additionally, heavy drinking can also raise your premiums, as it is linked to liver disease, accidents, and other health issues.

- Tip: Quitting smoking or reducing alcohol consumption before purchasing life insurance can help lower your premiums significantly.

- Credit History In some cases, insurance companies will look at your credit score when determining your premium. A poor credit score may result in higher premiums because insurers may view individuals with poor credit as more likely to file claims. While the relationship between credit score and life expectancy is not direct, insurers consider it as part of their overall risk assessment.

How to Lower Your Life Insurance Premiums

While some factors that affect your life insurance premium (such as age and gender) are out of your control, there are several things you can do to lower your premiums:

- Buy Life Insurance While You’re Young and Healthy

Purchasing life insurance early, when you’re young and healthy, locks in lower rates for the long term. As you age and your health potentially declines, premiums can increase, so the earlier you buy, the more affordable your premiums will be. - Quit Smoking

Smoking increases your life insurance premium significantly. If you smoke, quitting can help reduce your premiums over time. Many insurers offer discounts to non-smokers, and the longer you’ve been smoke-free, the better the rates you can secure. - Choose a Term Life Policy

If you’re looking for affordable coverage, term life insurance is usually the cheapest option. It provides coverage for a fixed period (e.g., 10, 20, or 30 years) and doesn’t accumulate cash value, making it less expensive than whole life insurance. - Maintain a Healthy Lifestyle

Staying active, eating a balanced diet, and maintaining a healthy weight can lower your life insurance premiums. Insurers reward those who have a healthy lifestyle, as they are considered less risky to insure. - Shop Around and Compare Quotes

Life insurance premiums can vary significantly between providers. To ensure you’re getting the best rate, shop around and compare quotes from different insurers. You can also work with an insurance broker who can help you find the most affordable coverage based on your needs.

Conclusion: Understanding Life Insurance Rates and Making Informed Decisions

Life insurance is an essential investment that can provide financial security for your loved ones in the event of your passing. Understanding the factors that affect your life insurance rates is crucial for finding affordable coverage that still meets your needs. By considering your age, health, lifestyle, and coverage preferences, you can secure a policy that provides peace of mind without breaking the bank.

To get the best rates, it’s important to shop around, maintain a healthy lifestyle, and consider options like term life insurance. By making informed decisions, you can find the right coverage that provides financial protection for your family while keeping your premiums manageable.